Stock traders will wade through dozens of earnings reports Thursday, but the real news comes Friday with the release of the July employment report.

Strong ISM nonmanufacturing data Wednesday helped cue up the bond market for a positive payrolls number that may support the idea of a Fed rate hike in September.

Goldman Sachs economists raised their forecast for nonfarm payrolls to 225,000 from 210,000 after the ISM nonmanufacturing survey surged to a 10-year high and included a surprisingly strong employment component. Economists expect a consensus 223,000 nonfarm payrolls, and an unchanged unemployment rate of 5.3 percent, according to Thomson Reuters.

Read More Here's what matters to the Fed

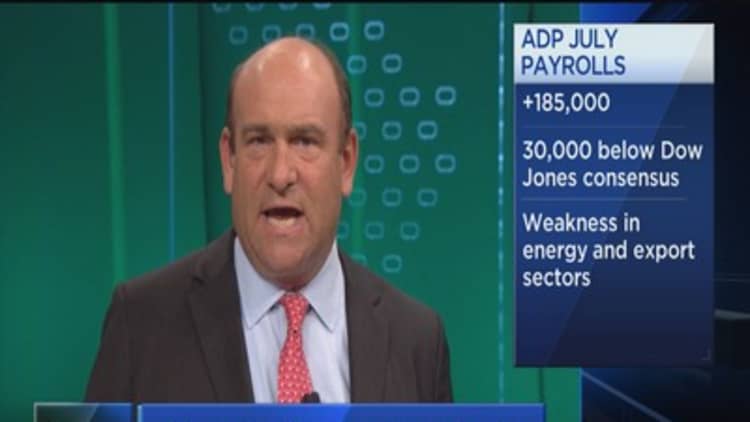

ADP data, meanwhile, showed only 185,000 private sector payrolls Wednesday, but the market shrugged it off and keyed off the stronger ISM data instead. That sent Treasury yields higher. The 2-year note reacts most to the idea of Fed tightening, and it rose to 0.73 percent.

"ISM was strong, but we walked in Monday and we looked toward Friday, and we're still looking towards Friday," said Justin Lederer, rates strategist at Cantor Fitzgerald. "I'd be surprised if we got a major move either way tomorrow, ahead of payrolls."

Read More Bond market brooding over Fed rate hike

Stocks Wednesday were mixed, with the Dow down 10 at 17,540, because of a 9.2 percent drop in Disney, after earnings. The S&P 500 was up 6 at 2,099.

Mark Luschini, chief strategist at Janney Montgomery, said the stock market is still struggling with weak internals. "The market internals are telling a weaker story than what the market headlines are telling investors. And that's got to be reconciled at some point," he said.

Read More Will jobs report tip the Fed's hand?

Thursday's data highlight is weekly jobless claims at 8:30 a.m. ET, and 271,000 claims are expected. The Bank of England also holds a rate meeting.

Earnings are expected from Viacom, Michael Kors, Duke Energy, Apache, Becton Dickinson, Molson Coors Brewing, Mylan Labs, Energizer, HSN, Teradata, Windstream, SeaWorld, New York Times, Chemours,AMC Networks and Elizabeth Arden ahead of the bell. Reports after the bell include Con Ed, EOG Resources, Wingstop, Lions Gate, Great Plains Energy, Noodles and Co., TrueCar, Zynga and Monster Beverage.

Read More